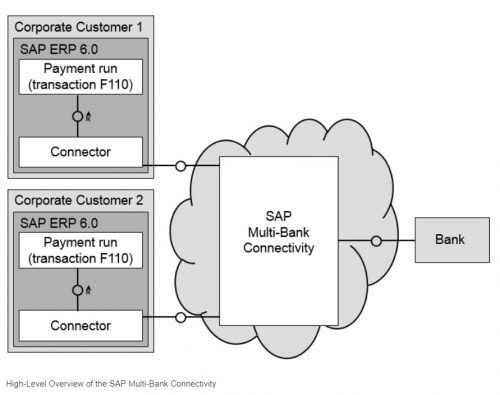

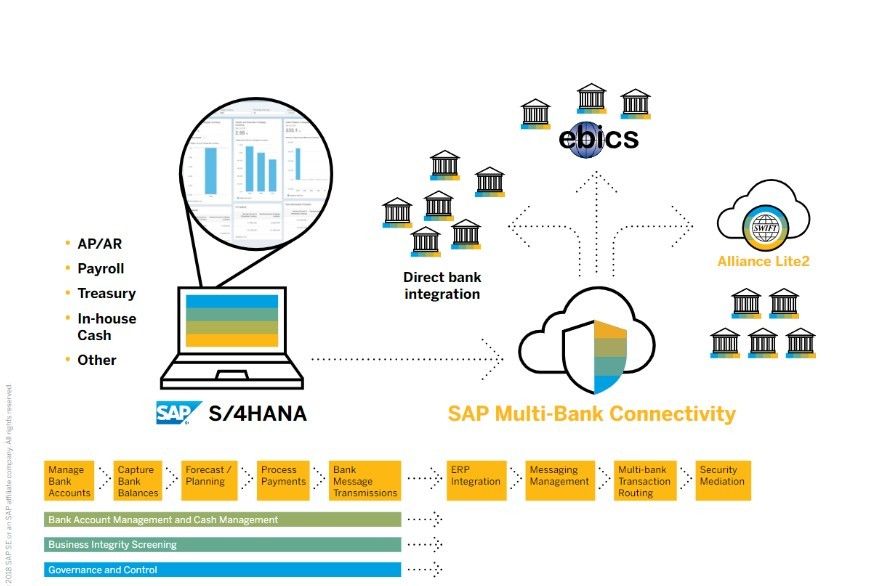

With SAP Multi-Bank Connectivity (MBC), SAP establishes connections with your banks to automatically send payment instructions, receive status notifications, receive bank statements, and receive lockbox messages. Leveraging the monitoring capabilities, you can supervise the status of all payment instructions and see which bank statements are received and which expected bank statements are still missing.

Key Process Steps Covered by Bank Integration with SAP Multi-Bank Connectivity

Connect securely with encryption between SAP S/4HANA and SAP Multi-Bank Connectivity and the connected financial institutions/banks

Forward payment instructions to banks in local format

Receive status notification for payment instructions

Receive bank statements in standard formats such as MT940, CAMT.053 and BAI2 Receive lock-box messages BAI2

Benefits of Bank Integration with SAP Multi-Bank Connectivity

Connect to banks via direct bank connections, SWIFT, or EBICS in a secure way (E2E encryption embedded)

Route payment instructions automatically to financial institutions/banks

Receive bank statements automatically from financial institutions/banks

Update payment status (only available in conjunction with Advanced Cash Management)

Receive lockbox messages automatically from financial institutions/banks

Get SAP-managed service with no custom integration

Does not require middleware

Where is Bank Integration with SAP Multi-Bank Connectivity being used?

This Scope item is used in the following way:

As a support function of Treasury Management within Finance Scope Item Group

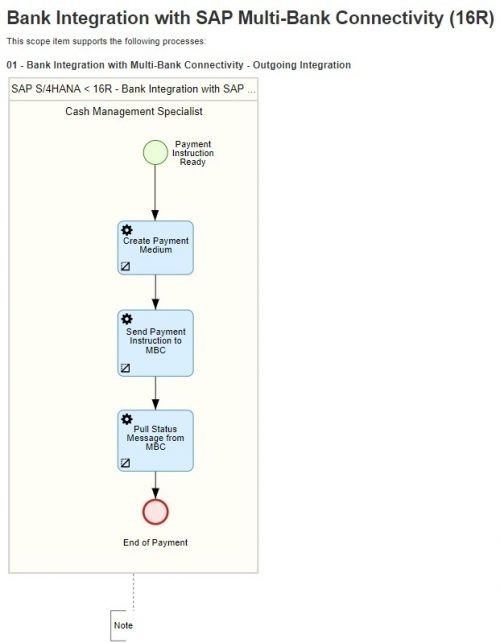

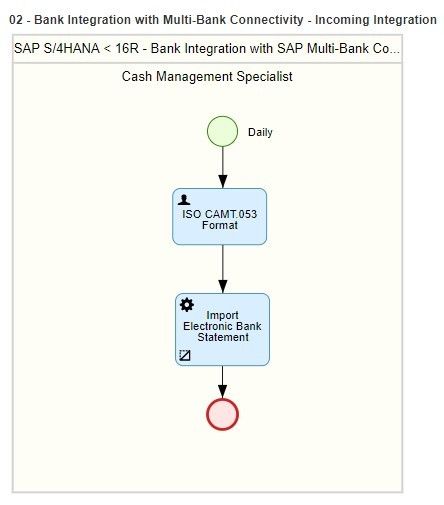

Process flow of Bank Integration with SAP Multi-Bank Connectivity

Find below the process flow of the scope item Bank Integration with SAP Multi-Bank Connectivity.

SAP Multi-Bank Connectivity – Provides transaction routing capabilities with the highest security standards This relates to the core digital via web services. MBC is installed via SAP Cloud Platform Interface and the maintenance is taken care by SAP upgrades to give an efficient end-to-end payment process within your treasury

SAP MBC can be procured as a scope item activation when you use SAP S/4HANA Cloud as your digital core. This scope item is 16R (SAP Multi-Bank Connectivity). The images below show the process flow of SAP Multi-Bank Connectivity in SAP S/4HANA Cloud. There are two steps in this process:

1.- Bank Integration with Multi-Bank Connectivity (Outgoing Integration) – This creates the payment medium and send the payment instruction to MBC.

2.- Bank Integration with Multi-Bank Connectivity (Incoming Integration)- This imports the electronic bank statements to update the cash management.

For more information, contact us at:

info@dycsi.com.mx

(210) 983 0477

About the Author

Joe Torres is the Founder and CEO of DYCSI Inc. He has over two decades of senior management experience in the IT and financial services industry with institutions such as Nacional Monte de Piedad and Banco Actinver.

Joe has seen success with roles in Technology Evolution, Bank Operations, Treasury and Risk Management, Contract and Lease Management and Money Laundry Prevention Systems, Banking Tellers and Emerging Technologies to Deliver Business Value.