According to The Financial Brand, consumers will start leaving banks and credit unions if these don't improve their digital offerings. The major turning point when digital banking transactions outstripped branch-based transactions has already passed. A much bigger milestone will be the point at which more consumers use digital-only providers as their primary financial institution than use traditional banks and credit unions. That day may be closer than many think.

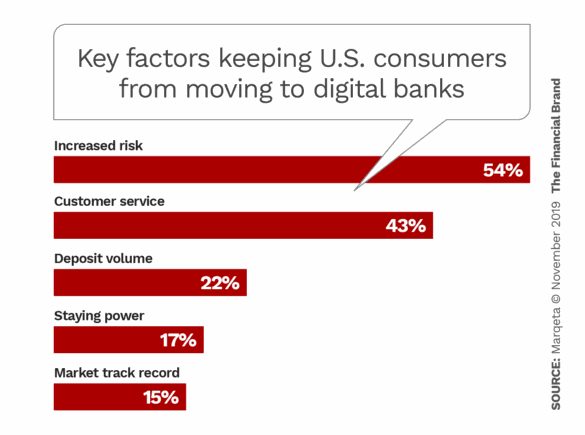

So why haven't more consumers already shifted their primary accounts over to a digital bank? The single biggest factor uncovered by Marqeta, a digital card issuer, is security. A big percentage of consumers feel a digital bank is a riskier place to put their money, and others have said that they would limit how much money they would deposit into a digital bank.

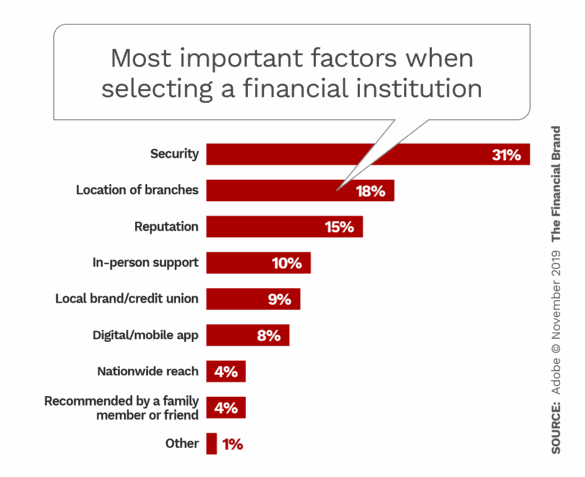

Data obtained by Adobe through a consumer survey shows that about a third of the approximately 1,000 respondents rank security as the most important factor when selecting a financial institution, far above reputation, digital capability and even branch location. Security ranks even higher with consumers in connection with online-only banks.

Clearly traditional banks and credit unions have the chops when it comes to security. And even Marqeta, a fintech company itself, notes that consumers’ perceptions about digital-bank risk could be slowing their adoption. "Digital banks need to do more to win the trust and confidence of customers," the company states.

Here in DYCSI, fulfilling your company’s needs is one of our top priorities, and we have the solutions that will take it to the next level. Contact us and receive free advice from our experts.

Source: The Financial Brand