The term neobank is a somewhat new term in the banking and financial services industry, but what actually is it?

Technology has seeped through every part of our lives, making much of our day to day business smarter and more efficient. Banking is no different. The term neobank first became prominent in 2017 to describe fintech based financial providers that were challenging traditional banks. There were two main types of company that provided services digitally:

companies that applied for their own banking license and,

companies that partnered with a traditional bank to provide those financial services.

A neobank (also known as an online bank, internet-only bank, or digital bank) is a type of direct bank that operates exclusively online without traditional physical branch networks.

Pros

The neobank product model tends to be aimed at a tech-savvy customer, who is typically after a simpler and more accessible way to manage money. Many offer free budgeting tools and financial education.

Due to most neobanks having fewer overheads like branches, as well as staff to run these branches and a generally slimmer business model, users commonly can enjoy higher interest rates and fewer fees. Most neobanks do not offer credit, which helps keep their costs down and limits their risks. It is also to be noted that a vast majority of these banks offer a physical debit card too as to not dampen the user experience.

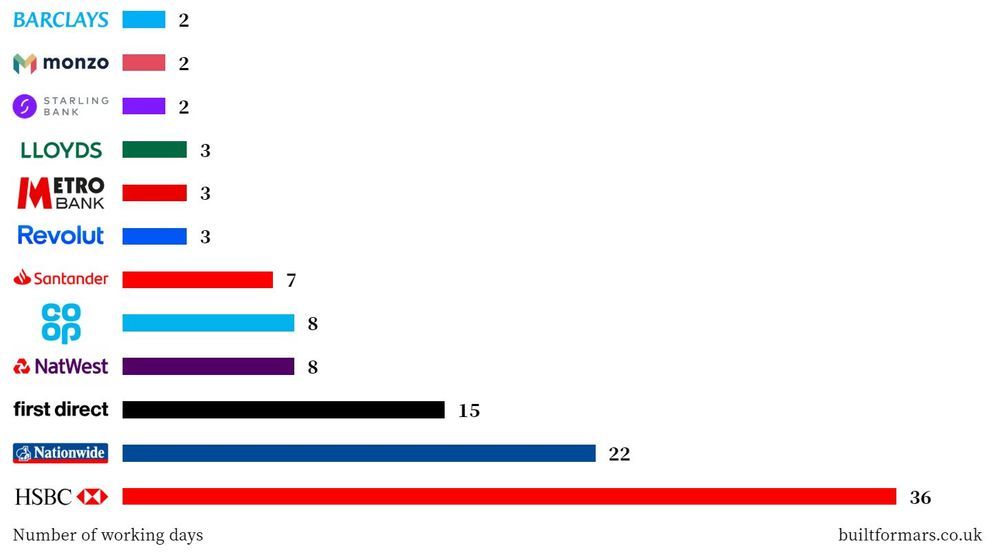

Another key point to be highlighted is the event of opening a bank account. Analyzing the experience of opening 12 different bank accounts, as expected, the digital banks were considerably faster than the more traditional banks. But when we talk about how easy something is, there’s another metric to consider: the effort required. Typically, products feel more intuitive—and easier—the less input they need. Although many of the neobanks are one step ahead on user experience and convenience, big banks are catching up.

Cons

The drawback of no physical branches to go into is you cannot speak to someone from your bank face to face. Speaking to a member of staff in person builds a level of rapport and trust that would be difficult to achieve otherwise.

Neobanks are less regulated than traditional banks and are not considered actual banks in some legal terms. It is a customer’s responsibility to be sure they choose a bank that offers a form of deposit insurance such as the National Credit Union Share Insurance Fund or the Federal Deposit Insurance Corporation. Big neobank are well regulated and reliable, hence their loyal customer bases, but it's always good to do some research.

Many neobanks have seen their customer numbers rocket over the past few years and, according to Business Insider, many of these banks in key global markets are prioritizing scale versus profitability. On average, a neobank loses $11 per user, mostly from operating costs and offering accounts for free, although many have subscriptions available for premium accounts with more features.

The next stage for many neobanks will be to pivot from a hyper-growth model to a long term more sustainable and profitable one. Despite the Coronavirus pandemic, many neobanks have seen customer bases soar from the need for more flexible banking. Having an agile workforce and a product and services that can be upheld by staff working from home has been paramount for success through COVID-19. As cash is being discouraged in favor of contactless card payments to limit the virus spread, the concept of a cashless society in the future seems to be more prevalent.

Contact us and learn how your Financial Institution can go digital with our solutions:

info@dycsi.com.mx

(210) 983 0477