Banks need to deliver customer-centric products, services, and experiences using a 360-degree customer view enabled by streamlined and automated banking operations and a seamlessly integrated finance, risk, and compliance system across retail and commercial banking businesses.

95% of financial services companies believe moving E2E processes or business processes to industry cloud would notably improve their ability to digitally transform their whole ecosystem.

The Vision

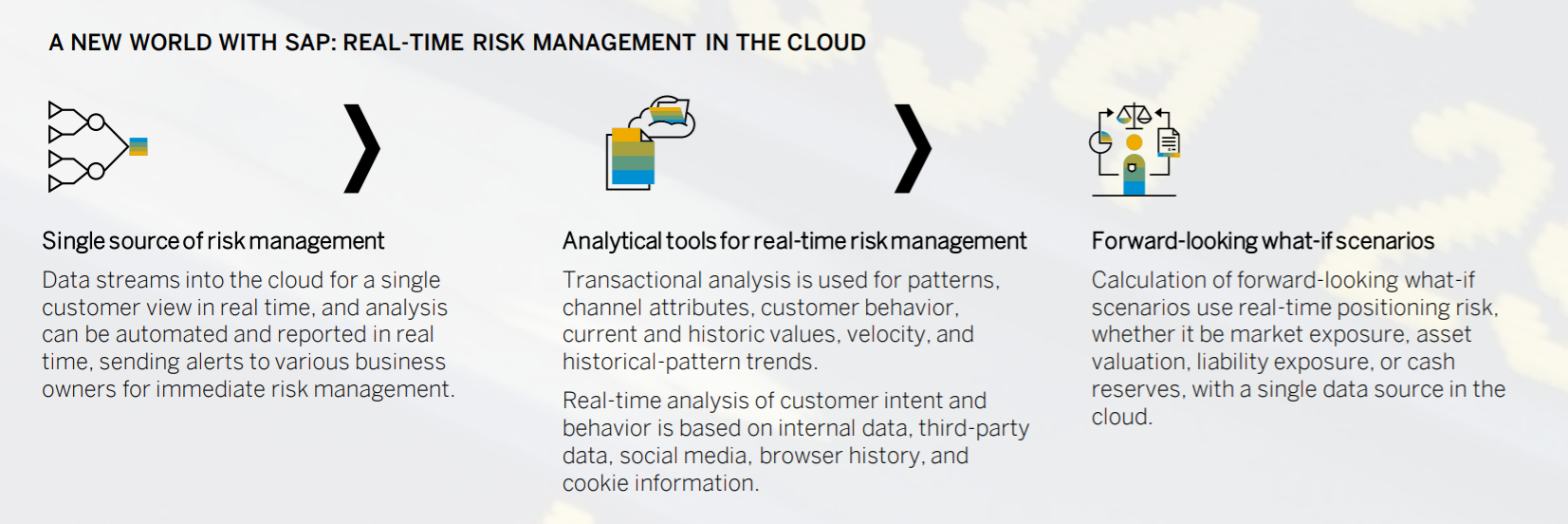

In 2025, banks will have fewer data silos and will be more connected to the customer through personalized services and better experiences. This connected view will provide agile product development and responsive action that will spawn the rise of outcome-based products – products that customers consume based on what they want. Leveraging customer and employee insights to reduce inefficiencies and anticipate opportunities will create loyalty, prevent churn, and maximize revenues. Data replication will be replaced with real-time connectivity, accessible anywhere from the cloud, allowing for real-time servicing. Decision-making will be enabled through real-time O-data and X-data secured by blockchain and served through the cloud. Latency will dramatically decrease, allowing greater operational efficiency.

The Journey

Banks will invest in the resources and capabilities needed to engage through preferred platforms and channels. Banks will introduce machine learning and AI technologies to leverage and manage O-data and X-data. By automating low-value, human-based activities – such as trade reconciliation, transaction matching, and ledger adjustment – banks will improve employee efficiency and leverage individuals’ talents and skills for higher-value, revenue-generating tasks. Finally, banks will adopt blockchain for a distributed ledger so that maintenance windows and batch processing will be limited and customers will experience no downtime. Blockchain changes the game by taking data from behind the firewall, making information available to external sources, and providing a full picture – enabling “open banking” in real time.

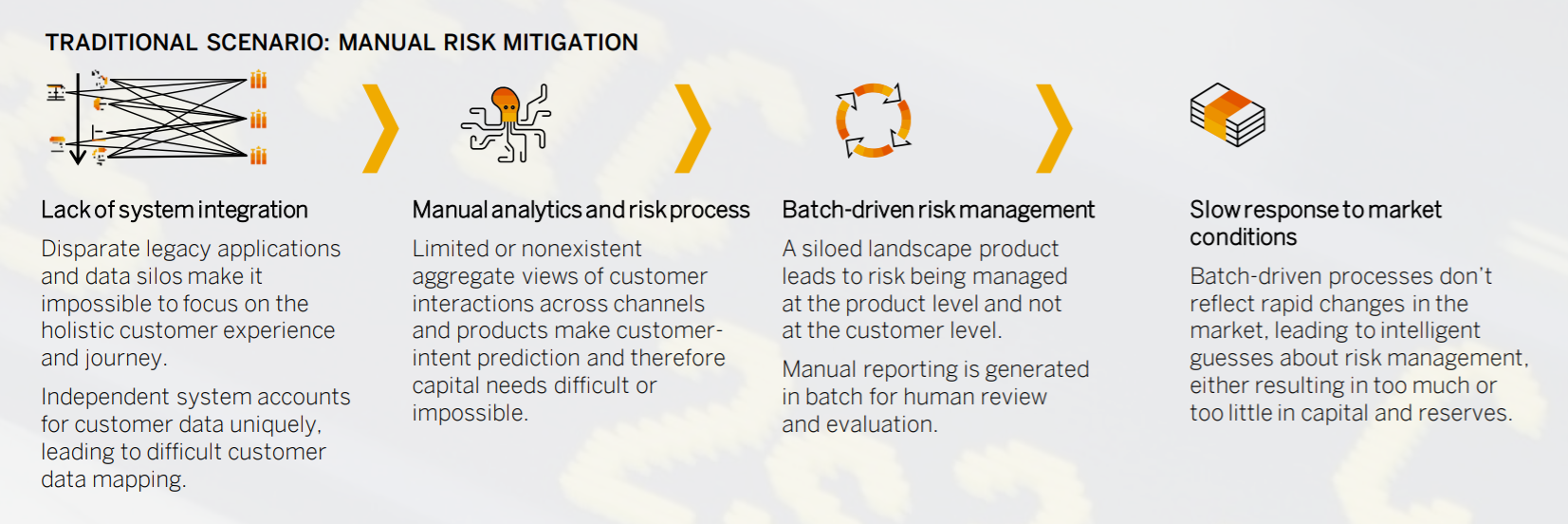

The ability to respond quickly is an essential part of managing a bank. To do this, simulation, prediction, and analytical capabilities are important components. Data is critical for gaining the insight to make decisions. This insight must be at a granular level, so decision-makers have the detail they need to understand trends, opportunities, and risks and quickly carry out what-if analysis using predictive algorithms. Banks are required to keep their systems and processes up to date in real time in a complex regulatory environment. They need to meet regulatory requirements in an easy and flexible way to keep costs down

A digital core is an IT architecture that offers stability and long-term reliability for core enterprise processes yet also provides the flexibility to adapt quickly to new opportunities, challenges, and regulations. This solid foundation gives you a single source of truth, which in turn enables flexibility for innovation to accommodate things such as new business models, new regulations, and business events such as mergers and acquisitions.