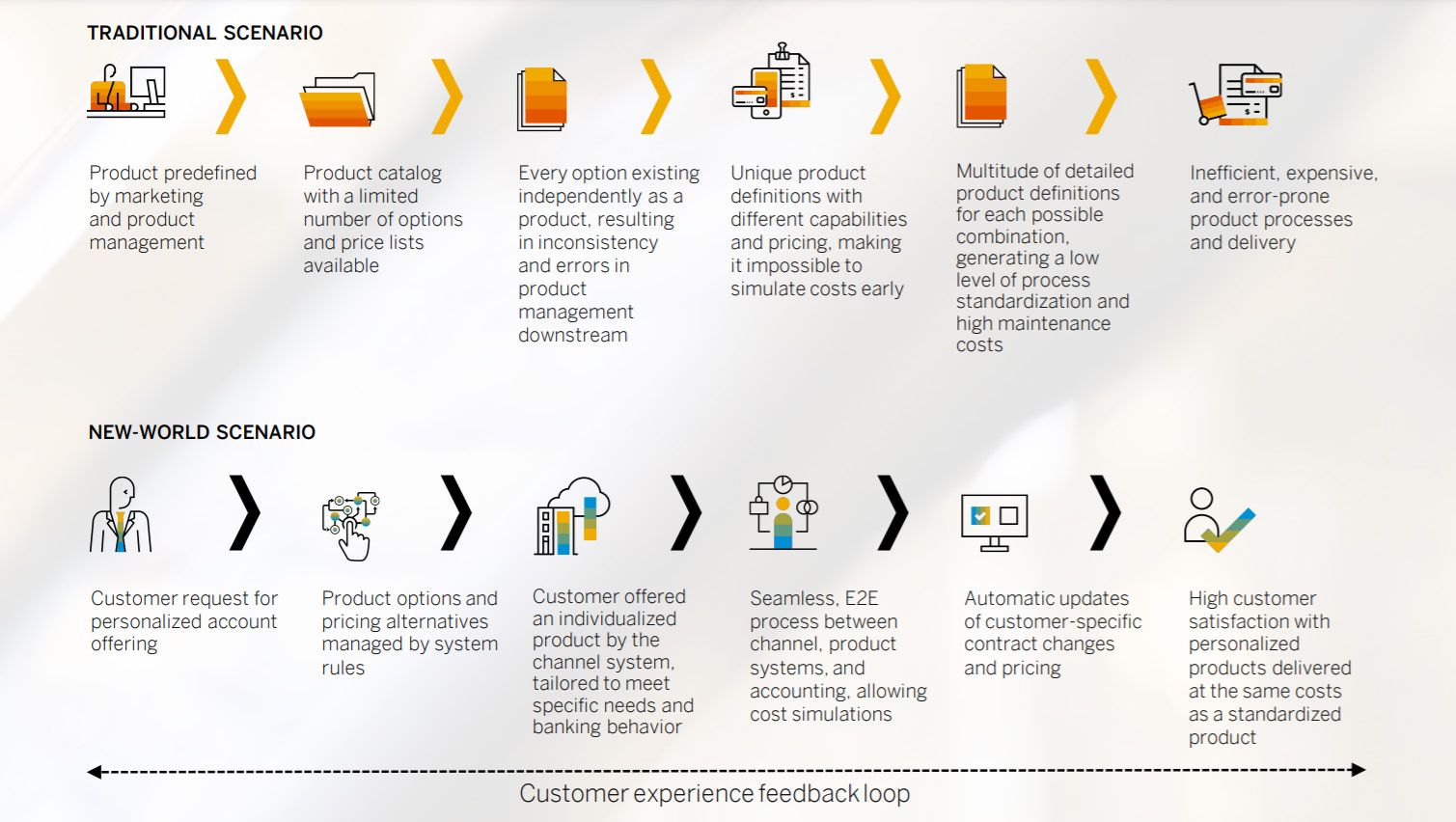

When customer experiences and needs are taken seriously, it becomes clear that one size seldom fits all.

Individuals as well as companies require solutions that are built to meet their exact requirements and differentiate them. On the other hand, customers are not willing to pay more than for a standard solution, which forces banks to move from rigid product models to approaches that include platforms and personalization to allow customization at scale.

The Vision

In 2025, banks will use deep data analytics to really understand their customers’ experiences, desires, and intended outcomes. This insight will allow smarter use of capital and will accelerate revenue growth. Banks will use data in an intelligent way to monitor risk factors and proactively position products and services based on the voice of the customer, helping to reduce churn and increase revenue. Banks will have a transformational, internal cultural change as incentives are aligned around servicing customers.

The Journey

Banks will start toward this goal by applying machine learning and AI to operational data (O-data) and experience data (X-data). Then they will be able to create, simulate, and forecast various business scenarios and financial impact using deep, real-time data analytics to understand customer and market behavior tied to intent. To achieve the cultural change needed, performance incentives will evolve from individual product sales to an aggregate customer satisfaction score correlated to the customer-of-one model.

Future of Data-Driven Intelligence

Every bank needs the computing capability to carry out complex algorithms with large operational and experience data sets to support timely, real-time analysis. Everyone in the bank must have access to the data they need, whenever and wherever they need it. This is also true for the rest of the

ecosystem. Compliance officers must be able to monitor transaction histories in real time to ensure policies and procedures are being followed.

Bankers must be able to see client history to assess credit risk and ensure the performance of client relationship management tasks, such as

addressing a poor customer experience. Banks should be able to process applications centrally, regardless of their source, in a digital, multichannel

world. They should be able to respond quickly, thanks to a high degree of automation. Decisions should be based on accurate and complete

customer information provided through automated application processing and seamless customer onboarding.