The banking industry is being reshaped by four major trends.

The quest for financial inclusion requires banks to take a leadership role in bringing financial services to underserved customers, creating opportunities for individuals, businesses, and economies. Financial inclusion is a key enabler to reducing poverty and boosting prosperity, resulting in:

Greater social and economic well-being for individuals

Higher profits, increased competitiveness, and growth for businesses

Greater economic growth and decreased inequality (income and gender) across economies

The four major trends are:

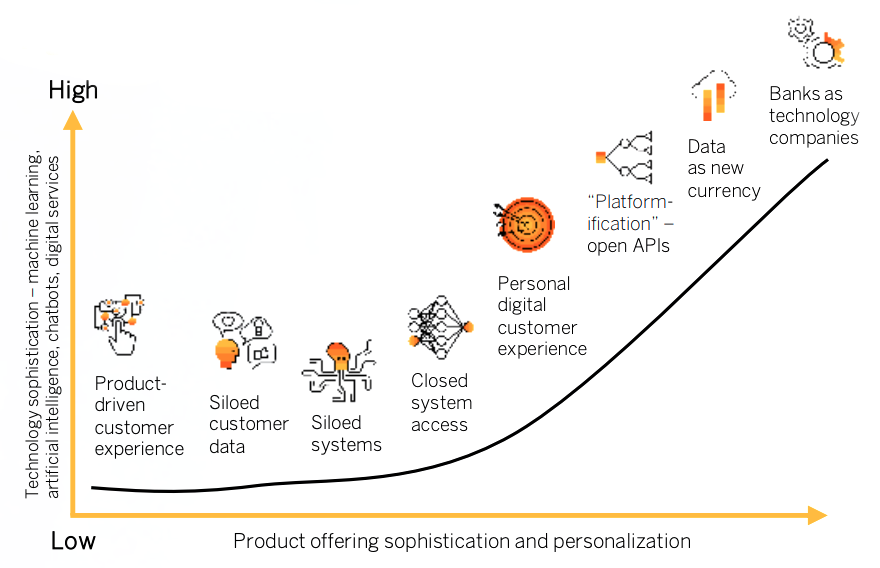

Increased customer expectations: Bank customers want and expect more from their banks. Today banks are trying to understand how to offer customized offers, products, and services beyond banking transactions while delivering the best customer experience.

Data as the new currency: Today, data analysis at banks is fragmented and piecemeal, making a deep understanding of customer needs and experiences very challenging. Banks are spending significant resources to reduce duplicate data and create a single view of each customer, from user history to user behavior, experience, and intent.

Platformification of banking: A new type of plug-and-play business model is appearing at banks that allows multiple participants (producers and consumers) to connect to the bank, interact with each other, and create and exchange value.

Evolution of banks into technology companies: Banks are reviewing and changing their organizational structure, technologies, and cultures to run more like technology companies than banks. To compete with the established technology firms for talent, they also need to understand and deliver the best employee experience.

By 2025 the role and revenue streams of banks will fundamentally change. A significant portion of bank revenue will come from nonbanking services. Banks will act as platforms for digital services.

These services will reflect a wide range of banking and related nonbanking services to deliver an end-to-end (E2E) service orchestrated by the bank. Digitalized solutions will address the customer of one anytime and anywhere. These services will span from simple after-sales services to more-complex outcome-as-a-service models and the monetization of data assets that banks are able to generate based on the business they conduct.

Experience management will emerge as a primary driver and differentiator for the bank. To achieve this vision, banks must integrate and increase transparency of their own E2E processes and operations.

Banks, now and in the future, need a real-world understanding of their customers’ experiences. They also need an environment in which they can learn from this information, make decisions, solve problems, and carefully manage the customer experience. By shifting routine tasks from humans to business systems enabled by machine learning, banks will free up the capacity needed to define and pursue innovative and transformative business models, thus becoming intelligent enterprises.