Leading banks plan to capture new business opportunities by driving customer experience, enhancing performance and financial management, focusing on a step change in productivity, and empowering innovation culture. Leaders focus on these four strategic priorities:

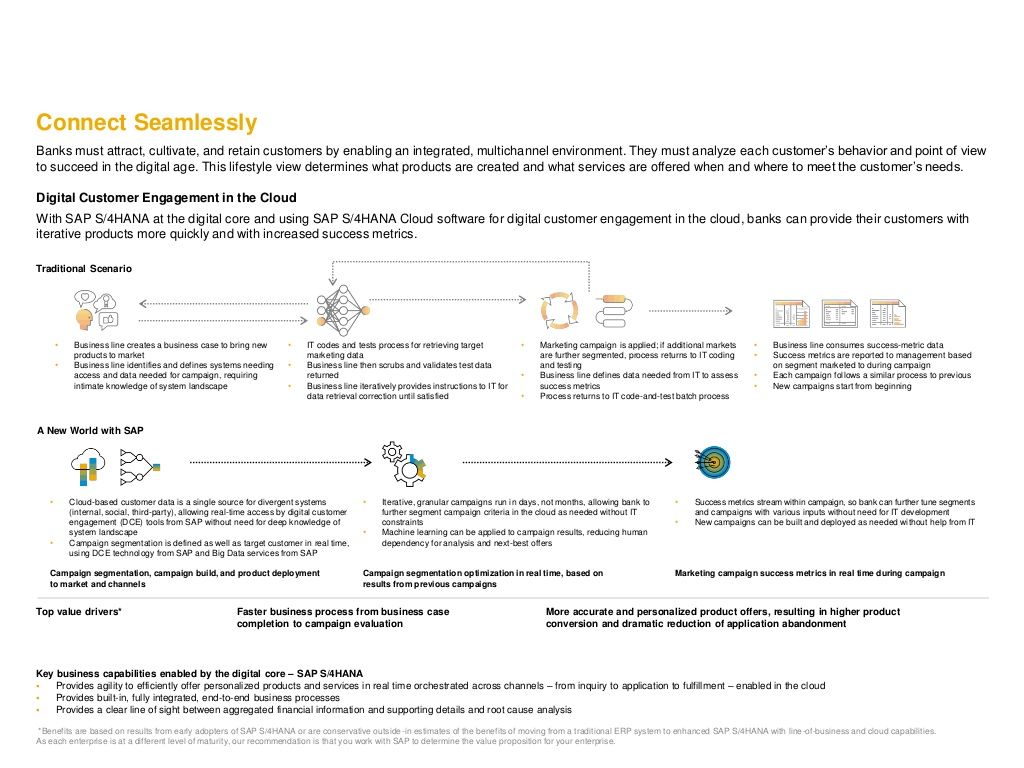

Ability to connect seamlessly

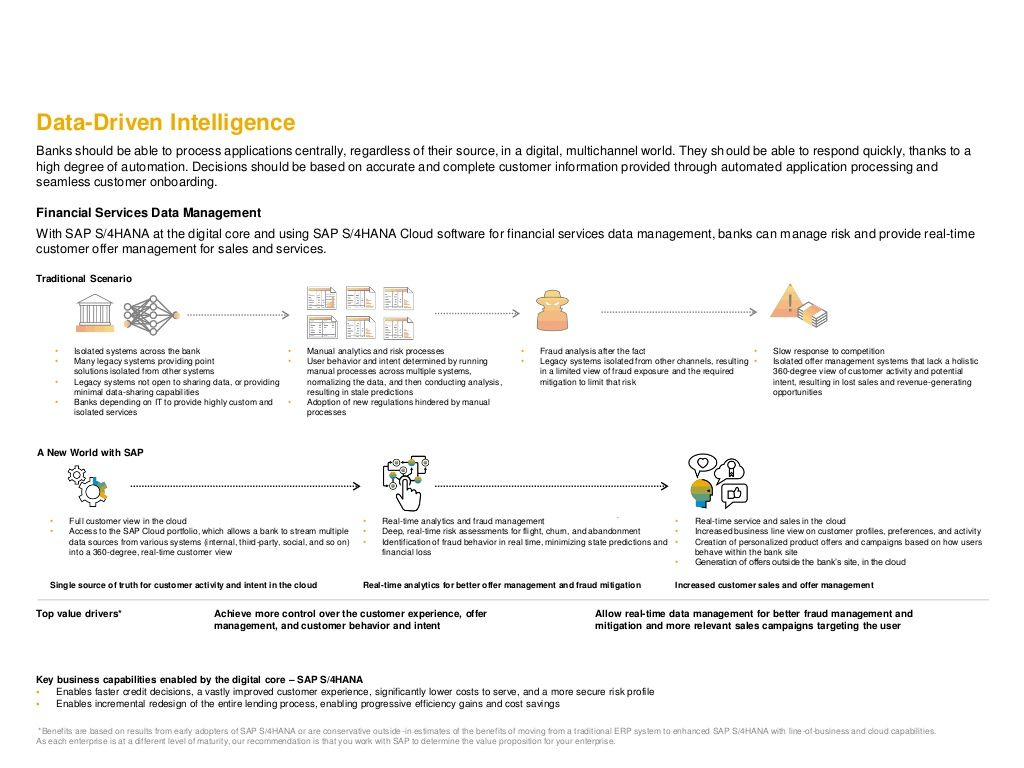

Data-driven intelligence

Operational effectiveness

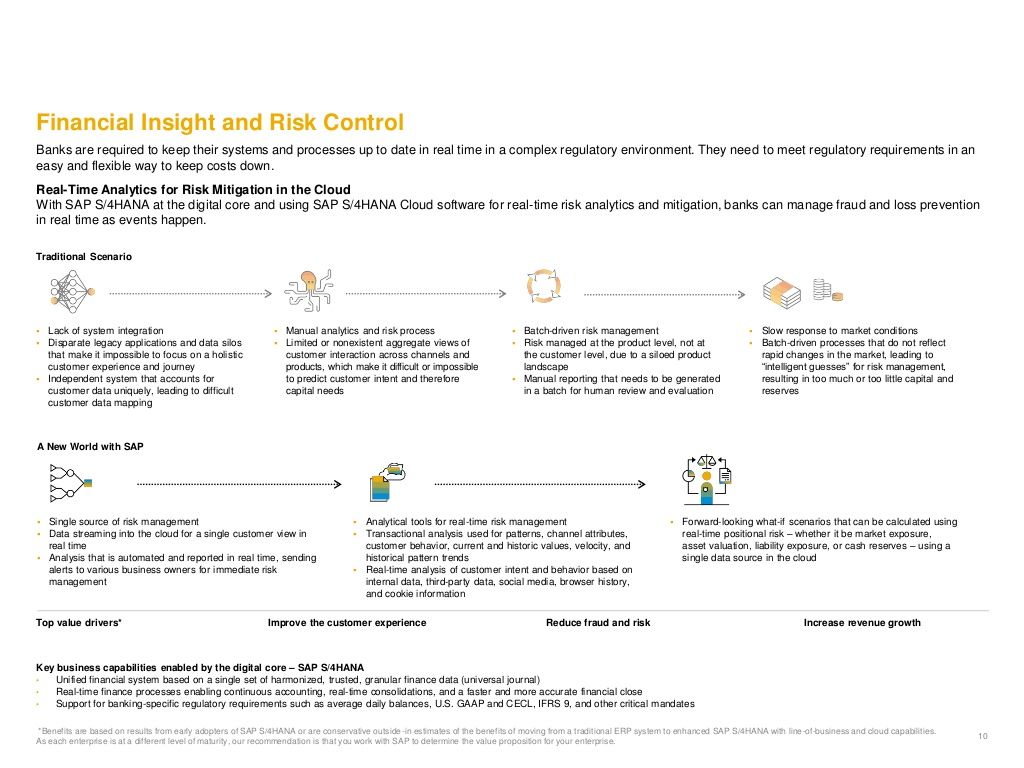

Financial insight and risk control

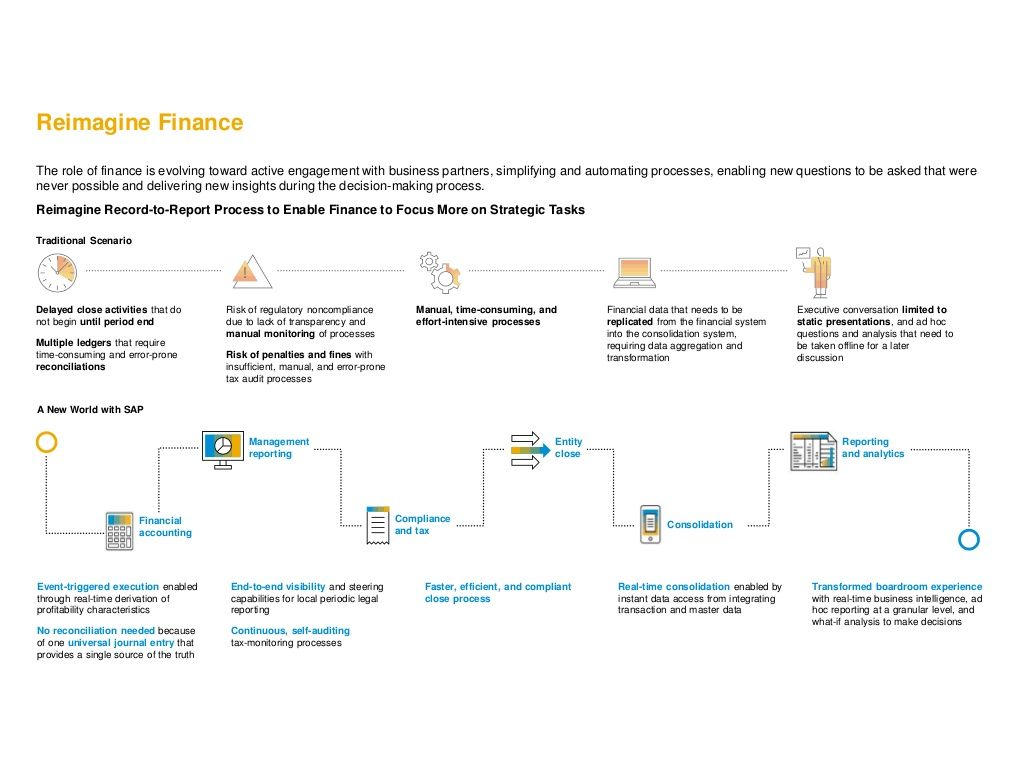

SAP® solutions with SAP S/4HANA® as the digital core can enable the business capabilities required to achieve these strategic priorities. For example, a bank might use the solutions to reimagine the record-to-report process by optimizing the financial close cycle and accelerating financial reporting.

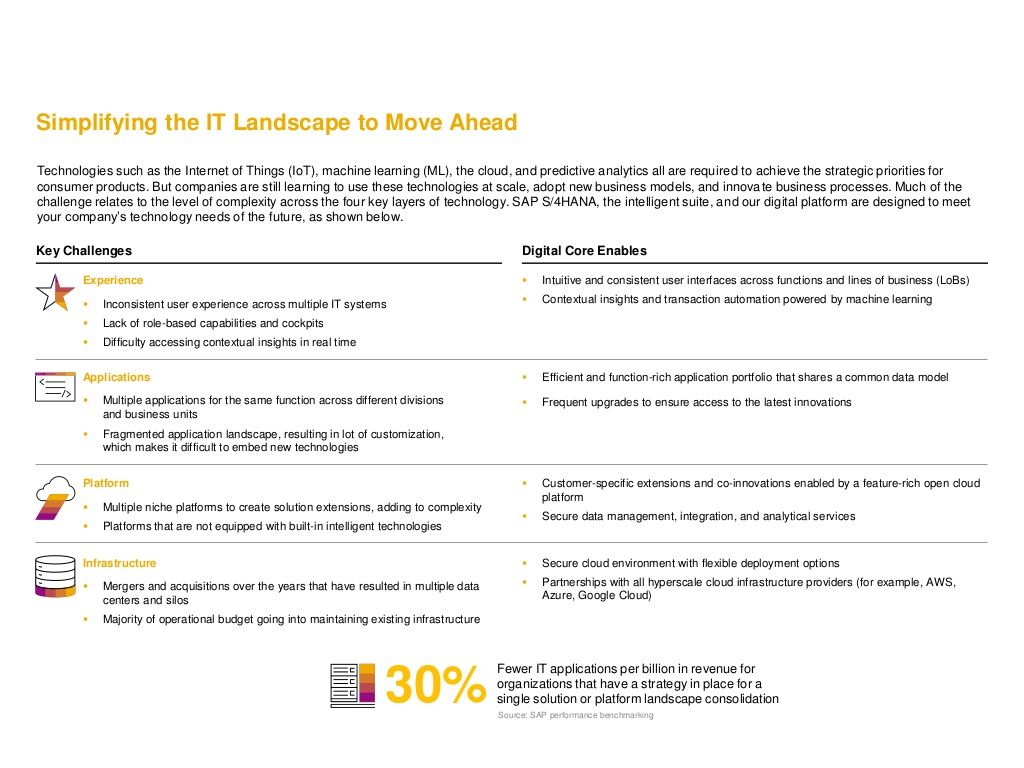

Implications for Your IT Landscape

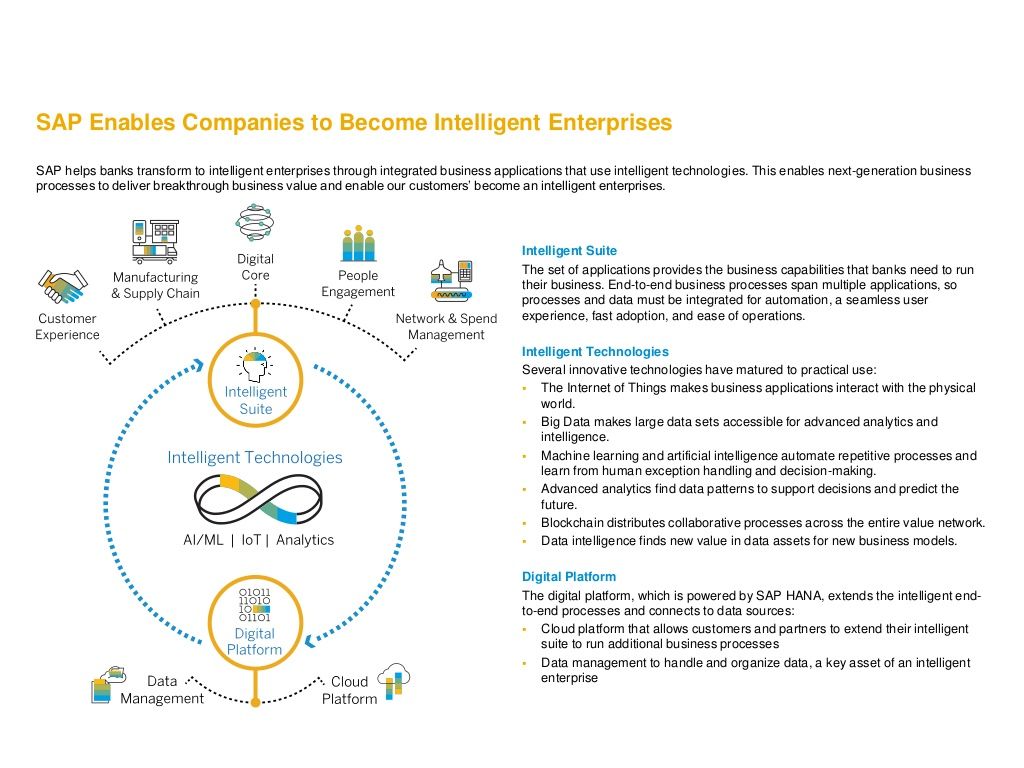

Banking leaders are also investing in an IT environment that enables these strategic priorities and meets expected future requirements. The SAP portfolio with the intelligent suite (including SAP S/4HANA), intelligent technologies, and open digital platform can provide the right technology stack to help meet business challenges.

Business Value

With SAP S/4HANA and other SAP solutions, you can:

Radically simplify the finance technology architecture, enabling continuous accounting

Enable dynamic planning, forecasting, and consolidation

Enable “lights out" transactional tasks augmented by emerging technologies (artificial intelligence, machine learning, Big Data analytics, and blockchain)

Provide best-of-breed banking functions such as average daily balances “on the fly” and multicurrency accounting

Provide a subledger and performance management integrated with SAP S/4HANA

Engage the workforce with a better user experience

Business Value – Digital Customer Experience and Core Banking

With SAP S/4HANA and other SAP solutions, you can:

Enable a consistent experience, no matter what the device

Enable focused customer offers in real time

Provide faster time to market for new products

Enable real-time processing and balances

Enhance responsiveness to regulatory mandates

Provide advanced cash management and payment services

How to Start

Given the tremendous potential value to be realized by successful transformation, your bank needs to start now by laying a strong foundation with SAP S/4HANA.

The simplified data model and modern user experience of SAP S/4HANA are exemplary, regardless of the selected deployment model (cloud, on premise, or a combination). Based on the business objectives, current landscape complexity, and IT strategy, your company can choose the right approach to transform its digital core.

Why SAP

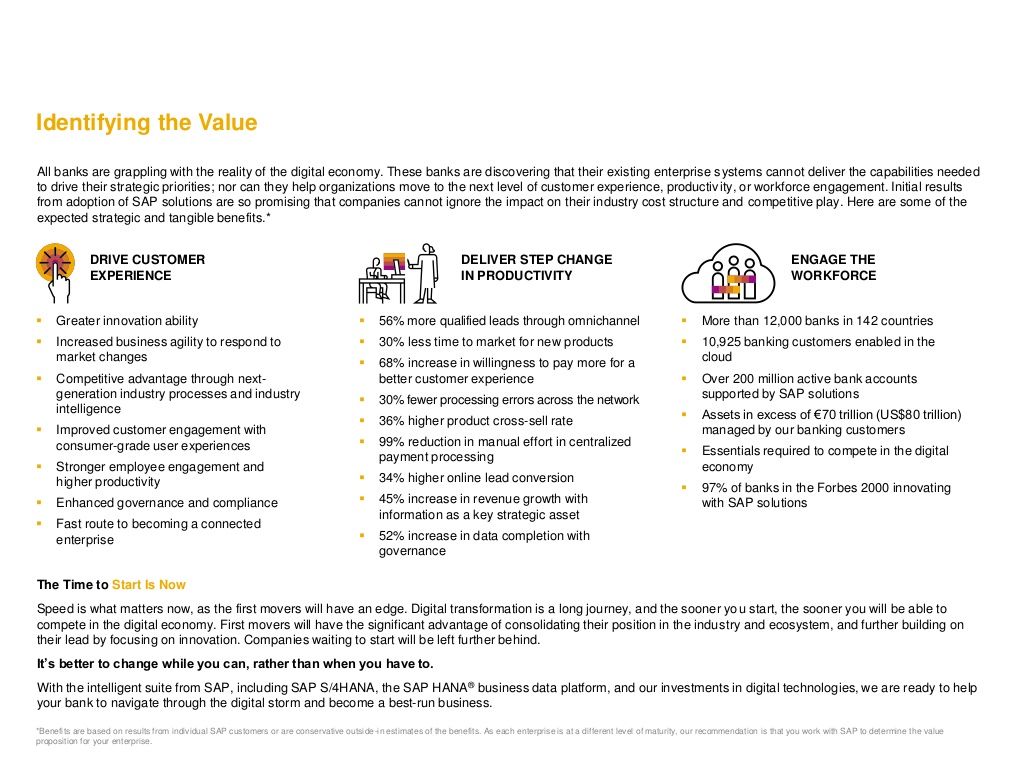

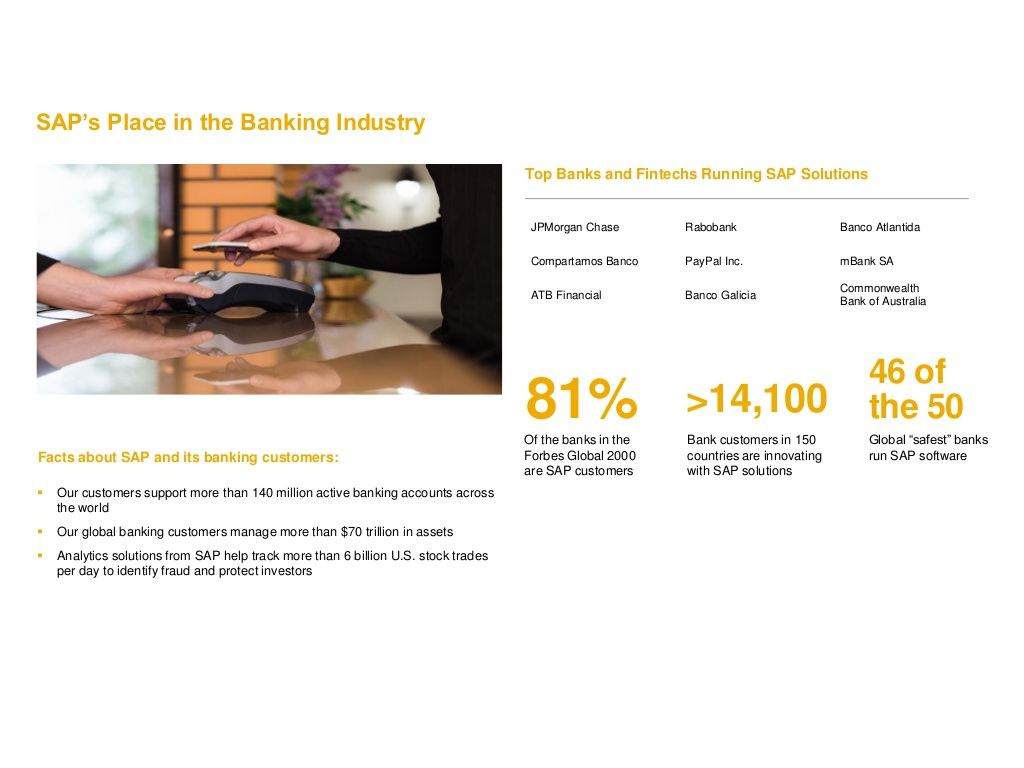

With more than 14,100 banking customers worldwide, deep industry-specific capabilities, and embedded, preconfigured best practices, SAP is strongly positioned to help banks on their digital transformation journey.

Facts about SAP and its banking customers:

Our customers support more than 140 million active banking accounts across the world

Our global banking customers manage more than $70 trillion in assets

Analytics solutions from SAP help track more than 6 billion U.S. stock trades per day to identify fraud and protect investors