𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗂𝗌 𝖺𝗇 𝗂𝗇𝗇𝗈𝗏𝖺𝗍𝗂𝗏𝖾 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗍𝗁𝖺𝗍 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗌 𝖻𝖺𝗇𝗄𝗌 𝖺𝗇𝖽 𝗈𝗍𝗁𝖾𝗋 𝖥𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 I𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝗐𝗂𝗍𝗁 𝗍𝗁𝖾𝗂𝗋 𝖢𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖢𝗎𝗌𝗍𝗈𝗆𝖾𝗋𝗌 𝗈𝗇 𝖺 𝗌𝖾𝖼𝗎𝗋𝖾 𝗇𝖾𝗍𝗐𝗈𝗋𝗄 𝗈𝗐𝗇𝖾𝖽 𝖺𝗇𝖽 𝗆𝖺𝗇𝖺𝗀𝖾𝖽 𝖻𝗒 𝖲𝖠𝖯. 𝖶𝗁𝖾𝗇 𝗂𝗇𝗍𝖾𝗋𝖺𝖼𝗍𝗂𝗇𝗀 𝗐𝗂𝗍𝗁 𝖬𝖡𝖢, 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗎𝗌𝗍𝗈𝗆𝖾𝗋𝗌 𝗌𝖾𝗇𝖽 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗂𝗇𝗌𝗍𝗋𝗎𝖼𝗍𝗂𝗈𝗇𝗌 𝗍𝗈 𝖬𝖡𝖢. 𝖡𝖺𝗇𝗄𝗌 𝗂𝗇 𝗍𝗎𝗋𝗇 𝗌𝖾𝗇𝖽 𝗍𝗋𝖺𝗇𝗌𝖺𝖼𝗍𝗂𝗈𝗇 𝗌𝗍𝖺𝗍𝗎𝗌 𝗂𝗇𝖿𝗈𝗋𝗆𝖺𝗍𝗂𝗈𝗇 𝖺𝗇𝖽 𝖺𝖼𝖼𝗈𝗎𝗇𝗍 𝗋𝖾𝗉𝗈𝗋𝗍𝗌 𝖻𝖺𝖼𝗄 𝗍𝗈 𝗍𝗁𝖾 𝖢𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗎𝗌𝗍𝗈𝗆𝖾𝗋. 𝖲𝖠𝖯 𝖬𝖡𝖢 𝗈𝗉𝖾𝗇𝗌 𝗍𝗁𝖾 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾-𝗍𝗈-𝖻𝖺𝗇𝗄 𝗋𝖾𝗅𝖺𝗍𝗂𝗈𝗇𝗌𝗁𝗂𝗉 𝗐𝗂𝗍𝗁 𝖺 𝗌𝖾𝖼𝗎𝗋𝖾 𝖻𝗎𝗌𝗂𝗇𝖾𝗌𝗌 𝗇𝖾𝗍𝗐𝗈𝗋𝗄.

𝖲𝖠𝖯 𝖬𝖡𝖢 𝖼𝗈𝗆𝖻𝗂𝗇𝖾𝗌 𝖲𝖠𝖯 𝖾𝗑𝗉𝖾𝗋𝗍𝗂𝗌𝖾 𝗂𝗇 𝖺𝗉𝗉𝗅𝗂𝖼𝖺𝗍𝗂𝗈𝗇𝗌, 𝖺𝗇𝖺𝗅𝗒𝗍𝗂𝖼𝗌, 𝖺𝗇𝖽 𝗂𝗇-𝗆𝖾𝗆𝗈𝗋𝗒 𝖼𝗈𝗆𝗉𝗎𝗍𝗂𝗇𝗀 𝗍𝗈 𝗉𝗋𝗈𝗏𝗂𝖽𝖾 𝖺 𝗌𝗍𝖺𝗇𝖽𝖺𝗋𝖽, 𝗈𝗇-𝖽𝖾𝗆𝖺𝗇𝖽 𝗂𝗇𝗇𝗈𝗏𝖺𝗍𝗂𝗏𝖾 𝗍𝖾𝖼𝗁𝗇𝗈𝗅𝗈𝗀𝗒 𝖿𝗈𝗋 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝖺𝗇𝖽 𝗍𝗁𝖾𝗂𝗋 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗎𝗌𝗍𝗈𝗆𝖾𝗋𝗌 𝗈𝗇 𝖺 𝗉𝗅𝖺𝗍𝖿𝗈𝗋𝗆 𝗍𝗁𝖺𝗍 𝖺𝖼𝖼𝗈𝗆𝗆𝗈𝖽𝖺𝗍𝖾𝗌 𝖿𝗎𝗍𝗎𝗋𝖾 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗇𝖾𝖾𝖽𝗌. 𝖠𝗌 𝗄𝖾𝗒 𝖻𝖾𝗇𝖾𝖿𝗂𝗍𝗌, 𝗍𝗁𝖾 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗌𝗂𝗆𝗉𝗅𝗂𝖿𝗂𝖾𝗌 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒, 𝖺𝗎𝗍𝗈𝗆𝖺𝗍𝖾𝗌 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗍𝗋𝖺𝗇𝗌𝖺𝖼𝗍𝗂𝗈𝗇𝗌, 𝗋𝖾𝖽𝗎𝖼𝖾𝗌 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗋𝖾𝗃𝖾𝖼𝗍𝗂𝗈𝗇 𝗋𝖺𝗍𝖾𝗌, 𝖾𝖺𝗌𝖾𝗌 𝗋𝖾𝖼𝗈𝗇𝖼𝗂𝗅𝗂𝖺𝗍𝗂𝗈𝗇, 𝖺𝗇𝖽 𝗉𝗋𝗈𝗏𝗂𝖽𝖾𝗌 𝖾𝗇𝗁𝖺𝗇𝖼𝖾𝖽 𝗏𝗂𝗌𝗂𝖻𝗂𝗅𝗂𝗍𝗒 𝗍𝗈 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝗍𝗋𝖾𝖺𝗌𝗎𝗋𝗒. 𝖨𝗇 𝗈𝗋𝖽𝖾𝗋 𝗍𝗈 𝖿𝗎𝗅𝖿𝗂𝗅𝗅 𝗍𝗁𝖾 𝗌𝗍𝗋𝗂𝗇𝗀𝖾𝗇𝗍 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒 𝗋𝖾𝗊𝗎𝗂𝗋𝖾𝗆𝖾𝗇𝗍𝗌 𝗈𝖿 𝗍𝗁𝖾 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝖽𝗎𝗌𝗍𝗋𝗒, 𝖲𝖠𝖯 𝖬𝖡𝖢 𝗂𝗆𝗉𝗅𝖾𝗆𝖾𝗇𝗍𝗌 𝖼𝗈𝗆𝗉𝗋𝖾𝗁𝖾𝗇𝗌𝗂𝗏𝖾 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒 𝗆𝖾𝖺𝗌𝗎𝗋𝖾𝗌 𝗂𝗇 𝗍𝗁𝖾 𝖺𝗋𝖾𝖺 𝗈𝖿 𝗉𝗁𝗒𝗌𝗂𝖼𝖺𝗅 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒, 𝗌𝗈𝖿𝗍𝗐𝖺𝗋𝖾 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒, 𝖺𝗇𝖽 𝗂𝗇𝖿𝗈𝗋𝗆𝖺𝗍𝗂𝗈𝗇 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒. 𝖲𝖾𝖼𝗎𝗋𝗂𝗍𝗒 𝖣𝖺𝗍𝖺𝗌𝗁𝖾𝖾𝗍.

𝖢𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗎𝗌𝗍𝗈𝗆𝖾𝗋𝗌 𝗌𝖾𝗇𝖽 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗂𝗇𝗌𝗍𝗋𝗎𝖼𝗍𝗂𝗈𝗇𝗌 𝗍𝗈 𝖬𝖡𝖢; 𝖻𝖺𝗇𝗄𝗌 𝗌𝖾𝗇𝖽 𝗍𝗋𝖺𝗇𝗌𝖺𝖼𝗍𝗂𝗈𝗇 𝗌𝗍𝖺𝗍𝗎𝗌 𝗂𝗇𝖿𝗈𝗋𝗆𝖺𝗍𝗂𝗈𝗇 𝖺𝗇𝖽 𝖺𝖼𝖼𝗈𝗎𝗇𝗍 𝗋𝖾𝗉𝗈𝗋𝗍𝗌. 𝖳𝗁𝗂𝗌 𝖽𝗈𝖼𝗎𝗆𝖾𝗇𝗍 𝗎𝗌𝖾𝗌 𝗍𝗁𝖾 𝗍𝖾𝗋𝗆 𝖬𝖡𝖢 𝗆𝖾𝗌𝗌𝖺𝗀𝖾 𝗍𝗈 𝗋𝖾𝖿𝖾𝗋 𝗍𝗈 𝖺𝗅𝗅 𝗍𝗁𝖾𝗌𝖾 𝗍𝗒𝗉𝖾𝗌 𝗈𝖿 𝖽𝖺𝗍𝖺. 𝖨𝖿 𝗋𝖾𝖿𝖾𝗋𝖾𝗇𝖼𝖾 𝗂𝗌 𝗆𝖺𝖽𝖾 𝗍𝗈 𝖺 𝗌𝗉𝖾𝖼𝗂𝖿𝗂𝖼 𝗍𝗒𝗉𝖾 𝗈𝖿 𝖬𝖡𝖢 𝗆𝖾𝗌𝗌𝖺𝗀𝖾, 𝗍𝗁𝖾 𝗌𝗉𝖾𝖼𝗂𝖿𝗂𝖼 𝗍𝖾𝗋𝗆 𝗂𝗌 𝗎𝗌𝖾𝖽, 𝖿𝗈𝗋 𝖾𝗑𝖺𝗆𝗉𝗅𝖾, 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗂𝗇𝗌𝗍𝗋𝗎𝖼𝗍𝗂𝗈𝗇.

𝖳𝗁𝖾 𝖲𝖠𝖯 𝖬𝖡𝖢 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗈𝖿𝖿𝖾𝗋𝗌 𝗆𝗎𝗅𝗍𝗂𝗉𝗅𝖾 𝗌𝖾𝗋𝗏𝗂𝖼𝖾𝗌 𝗈𝗏𝖾𝗋 𝗈𝗇𝖾 𝗌𝗂𝗇𝗀𝗅𝖾 𝖼𝗁𝖺𝗇𝗇𝖾𝗅, 𝗐𝗁𝗂𝗅𝖾 𝗌𝗎𝗉𝗉𝗈𝗋𝗍𝗂𝗇𝗀 𝗍𝗁𝖾 𝖽𝖾𝗉𝗅𝗈𝗒𝗆𝖾𝗇𝗍 𝗈𝖿 𝗇𝖾𝗐 𝗈𝗇𝖾𝗌.

𝖢𝗅𝗈𝗎𝖽 𝖽𝖾𝗉𝗅𝗈𝗒𝗆𝖾𝗇𝗍

𝖭𝖺𝗍𝗂𝗏𝖾 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗐𝗂𝗍𝗁 𝖲𝖠𝖯 𝖤𝖱𝖯 𝖺𝗇𝖽 𝖲𝖠𝖯 𝖲/𝟦𝖧𝖠𝖭𝖠

𝖠𝗎𝗍𝗈𝗆𝖺𝗍𝖾𝖽 𝖻𝖺𝗇𝗄 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇

𝖲𝗎𝗉𝗉𝗈𝗋𝗍 𝖿𝗈𝗋 𝖲𝖶𝖨𝖥𝖳 𝖺𝗇𝖽 𝖤𝖡𝖨𝖢𝖲 𝗋𝖾𝗊𝗎𝗂𝗋𝖾𝗆𝖾𝗇𝗍𝗌

𝖨𝗇𝗍𝖾𝗅𝗅𝗂𝗀𝖾𝗇𝗍 𝖳𝗋𝖾𝖺𝗌𝗎𝗋𝗒 𝖬𝖺𝗇𝖺𝗀𝖾𝗆𝖾𝗇𝗍 𝗐𝗂𝗍𝗁 𝖨𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝖾𝖽 𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒

𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝖻𝖾𝗍𝗐𝖾𝖾𝗇 𝗒𝗈𝗎𝗋 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗌𝗒𝗌𝗍𝖾𝗆 𝖺𝗇𝖽 𝖻𝖺𝗇𝗄𝗂𝗇𝗀 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝗂𝗌 𝖾𝗌𝗌𝖾𝗇𝗍𝗂𝖺𝗅 𝖿𝗈𝗋 𝖽𝖺𝗂𝗅𝗒 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗈𝗉𝖾𝗋𝖺𝗍𝗂𝗈𝗇𝗌. 𝖯𝗋𝗈𝗏𝗂𝖽𝗂𝗇𝗀 𝖾𝗆𝖻𝖾𝖽𝖽𝖾𝖽 𝖺𝖼𝖼𝖾𝗌𝗌 𝗍𝗈 𝖺 𝗇𝖾𝗍𝗐𝗈𝗋𝗄 𝗈𝖿 𝗈𝗏𝖾𝗋 𝟣𝟣,𝟢𝟢𝟢 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌, 𝗍𝗁𝖾 𝖲𝖠𝖯® 𝖬𝖡𝖢 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗅𝗈𝗐𝖾𝗋𝗌 𝗍𝗁𝖾 𝖻𝖺𝗋𝗋𝗂𝖾𝗋𝗌 𝗍𝗈 𝖾𝗇𝗍𝗋𝗒 𝖿𝗈𝗋 𝖼𝗈𝗆𝗉𝖺𝗇𝗂𝖾𝗌 𝗍𝗈 𝖼𝗈𝗇𝗇𝖾𝖼𝗍 𝗐𝗂𝗍𝗁 𝖻𝖺𝗇𝗄𝗌 𝗀𝗅𝗈𝖻𝖺𝗅𝗅𝗒. 𝖨𝗍 𝖺𝗅𝗅𝗈𝗐𝗌 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗅𝗂𝖾𝗇𝗍𝗌 𝗍𝗈 𝖾𝗌𝗍𝖺𝖻𝗅𝗂𝗌𝗁 𝗌𝖾𝖼𝗎𝗋𝖾 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗍𝗈 𝗍𝗁𝖾𝗂𝗋 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌, 𝗋𝖾𝖽𝗎𝖼𝗂𝗇𝗀 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝖾𝖿𝖿𝗈𝗋𝗍𝗌 𝖺𝗇𝖽 𝖾𝗇𝖺𝖻𝗅𝗂𝗇𝗀 𝖻𝗎𝗌𝗂𝗇𝖾𝗌𝗌𝖾𝗌 𝗍𝗈 𝖺𝖽𝖺𝗉𝗍 𝗍𝗈 𝖺 𝗋𝖺𝗉𝗂𝖽𝗅𝗒 𝖼𝗁𝖺𝗇𝗀𝗂𝗇𝗀 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗌𝗂𝗍𝗎𝖺𝗍𝗂𝗈𝗇. 𝖡𝖺𝗌𝖾𝖽 𝗈𝗇 𝖲𝖠𝖯 𝖢𝗅𝗈𝗎𝖽 𝖯𝗅𝖺𝗍𝖿𝗈𝗋𝗆, 𝗍𝗁𝖾 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗂𝗌 𝗇𝖺𝗍𝗂𝗏𝖾𝗅𝗒 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝖾𝖽 𝗐𝗂𝗍𝗁 𝗍𝗁𝖾 𝖲𝖶𝖨𝖥𝖳 𝗇𝖾𝗍𝗐𝗈𝗋𝗄, 𝗀𝗂𝗏𝗂𝗇𝗀 𝗒𝗈𝗎 𝖺 𝗌𝗂𝗇𝗀𝗅𝖾 𝗉𝗈𝗂𝗇𝗍 𝗍𝗈 𝗈𝗇𝖻𝗈𝖺𝗋𝖽 𝗇𝖾𝗐 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝖺𝗇𝖽 𝗀𝖾𝗍 𝗂𝗇𝖼𝗋𝖾𝖺𝗌𝖾𝖽 𝗏𝗂𝗌𝗂𝖻𝗂𝗅𝗂𝗍𝗒 𝗂𝗇𝗍𝗈 𝖺𝗅𝗅 𝗒𝗈𝗎𝗋 𝖻𝖺𝗇𝗄 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗈𝗇𝗌.

𝖮𝖻𝗃𝖾𝖼𝗍𝗂𝗏𝖾𝗌

𝖡𝖾𝗇𝖾𝖿𝗂𝗍 𝖿𝗋𝗈𝗆 𝖺 𝗌𝗂𝗇𝗀𝗅𝖾 𝗉𝗈𝗂𝗇𝗍 𝗈𝖿 𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾-𝗍𝗈-𝖻𝖺𝗇𝗄 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒

𝖨𝗇𝖼𝗋𝖾𝖺𝗌𝖾 𝗏𝗂𝗌𝗂𝖻𝗂𝗅𝗂𝗍𝗒 𝖺𝗇𝖽 𝖼𝗈𝗇𝗍𝗋𝗈𝗅 𝗈𝗏𝖾𝗋 𝖺𝗅𝗅 𝗒𝗈𝗎𝗋 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗈𝗇𝗌 𝗍𝗈 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌

𝖮𝗇𝖻𝗈𝖺𝗋𝖽 𝗇𝖾𝗐 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝗊𝗎𝗂𝖼𝗄𝗅𝗒 𝖺𝗇𝖽 𝖾𝖺𝗌𝗂𝗅𝗒

𝖲𝗈𝗅𝗎𝗍𝗂𝗈𝗇

𝖥𝗅𝖾𝗑𝗂𝖻𝗅𝖾, 𝖻𝖺𝗇𝗄-𝖺𝗀𝗇𝗈𝗌𝗍𝗂𝖼 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝖿𝗈𝗋 𝗆𝗎𝗅𝗍𝗂-𝖻𝖺𝗇𝗄 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒

𝖫𝗈𝗐-𝖿𝗈𝗈𝗍𝗉𝗋𝗂𝗇𝗍, 𝖼𝗅𝗈𝗎𝖽-𝖻𝖺𝗌𝖾𝖽 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇

𝖠𝖼𝖼𝖾𝗌𝗌 𝗍𝗈 𝖺 𝗀𝗅𝗈𝖻𝖺𝗅 𝗇𝖾𝗍𝗐𝗈𝗋𝗄 𝗈𝖿 𝗈𝗏𝖾𝗋 𝟣𝟣,𝟢𝟢𝟢 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌

𝖥𝗎𝗅𝗅 𝗆𝗎𝗅𝗍𝗂-𝖻𝖺𝗇𝗄 𝗈𝗇𝖻𝗈𝖺𝗋𝖽𝗂𝗇𝗀 𝖺𝗇𝖽 𝗋𝗈𝗎𝗍𝗂𝗇𝗀

𝖨𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗐𝗂𝗍𝗁 𝖲𝖠𝖯 𝖲/𝟦𝖧𝖠𝖭𝖠® 𝖺𝗇𝖽 𝖲𝖠𝖯 𝖤𝖱𝖯

𝖡𝖾𝗇𝖾𝖿𝗂𝗍𝗌

𝖫𝖾𝗌𝗌 𝗍𝗂𝗆𝖾 𝗋𝖾𝗊𝗎𝗂𝗋𝖾𝖽 𝗍𝗈 𝖼𝗈𝗇𝗇𝖾𝖼𝗍 𝗍𝗈 𝖺𝖽𝖽𝗂𝗍𝗂𝗈𝗇𝖺𝗅 𝖻𝖺𝗇𝗄𝗌

𝖱𝖾𝖽𝗎𝖼𝖾𝖽 𝗈𝗉𝖾𝗋𝖺𝗍𝗂𝗈𝗇𝖺𝗅 𝗋𝗂𝗌𝗄 𝗍𝗁𝖺𝗇𝗄𝗌 𝗍𝗈 𝗀𝗋𝖾𝖺𝗍𝖾𝗋 𝗍𝗋𝖺𝗇𝗌𝗉𝖺𝗋𝖾𝗇𝖼𝗒

𝖱𝗈𝖻𝗎𝗌𝗍 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒 𝗈𝗇 𝖲𝖠𝖯 𝖢𝗅𝗈𝗎𝖽 𝖯𝗅𝖺𝗍𝖿𝗈𝗋𝗆

𝖤𝗇𝖽-𝗍𝗈-𝖾𝗇𝖽 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗌𝗍𝖺𝗍𝗎𝗌 𝗍𝗋𝖺𝖼𝗄𝗂𝗇𝗀

𝖬𝖺𝗂𝗇𝗍𝖾𝗇𝖺𝗇𝖼𝖾 𝖺𝗇𝖽 𝗎𝗉𝗀𝗋𝖺𝖽𝖾𝗌 𝗉𝖾𝗋𝖿𝗈𝗋𝗆𝖾𝖽 𝖻𝗒 𝖲𝖠𝖯

𝖱𝖾𝖽𝗎𝖼𝖾𝖽 𝖼𝗈𝗆𝗉𝗅𝖾𝗑𝗂𝗍𝗒 𝖺𝗇𝖽 𝗅𝗈𝗐 𝗋𝗎𝗇𝗇𝗂𝗇𝗀 𝖼𝗈𝗌𝗍𝗌

𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝖻𝖾𝗍𝗐𝖾𝖾𝗇 𝗒𝗈𝗎𝗋 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗌𝗒𝗌𝗍𝖾𝗆 𝖺𝗇𝖽 𝖻𝖺𝗇𝗄𝗂𝗇𝗀 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌 𝗂𝗌 𝖾𝗌𝗌𝖾𝗇𝗍𝗂𝖺𝗅 𝖿𝗈𝗋 𝖽𝖺𝗂𝗅𝗒 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗈𝗉𝖾𝗋𝖺𝗍𝗂𝗈𝗇𝗌. 𝖧𝗈𝗐𝖾𝗏𝖾𝗋, 𝗐𝗁𝖾𝗇 𝗒𝗈𝗎 𝖽𝖾𝖺𝗅 𝗐𝗂𝗍𝗁 𝖺 𝗆𝗎𝗅𝗍𝗂𝗍𝗎𝖽𝖾 𝗈𝖿 𝖻𝖺𝗇𝗄𝗌 𝗎𝗌𝗂𝗇𝗀 𝖽𝗂𝖿𝖿𝖾𝗋𝖾𝗇𝗍 𝗌𝗍𝖺𝗇𝖽𝖺𝗋𝖽𝗌 𝗍𝗈 𝖾𝗑𝖼𝗁𝖺𝗇𝗀𝖾 𝗂𝗇𝖿𝗈𝗋𝗆𝖺𝗍𝗂𝗈𝗇, 𝖾𝗌𝗍𝖺𝖻𝗅𝗂𝗌𝗁𝗂𝗇𝗀 𝖺𝗇𝖽 𝗆𝖺𝗂𝗇𝗍𝖺𝗂𝗇𝗂𝗇𝗀 𝗉𝗋𝗈𝗉𝗋𝗂𝖾𝗍𝖺𝗋𝗒 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗈𝗇𝗌 𝖻𝖾𝖼𝗈𝗆𝖾𝗌 𝖼𝗈𝗆𝗉𝗅𝖾𝗑 𝖺𝗇𝖽 𝗍𝗂𝗆𝖾-𝖼𝗈𝗇𝗌𝗎𝗆𝗂𝗇𝗀. 𝖶𝗂𝗍𝗁 𝗍𝗁𝖾 𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇, 𝖿𝖾𝖺𝗍𝗎𝗋𝗂𝗇𝗀 𝗇𝖺𝗍𝗂𝗏𝖾 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗍𝗈 𝗍𝗁𝖾 𝖲𝖶𝖨𝖥𝖳 𝗇𝖾𝗍𝗐𝗈𝗋𝗄, 𝗒𝗈𝗎 𝗁𝖺𝗏𝖾 𝖺 𝗌𝗂𝗇𝗀𝗅𝖾 𝗉𝗈𝗂𝗇𝗍 𝗈𝖿 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗈𝗇 𝗍𝗈 𝖺𝗅𝗅 𝗍𝗁𝖾 𝖻𝖺𝗇𝗄𝗌 𝗒𝗈𝗎 𝗎𝗌𝖾.

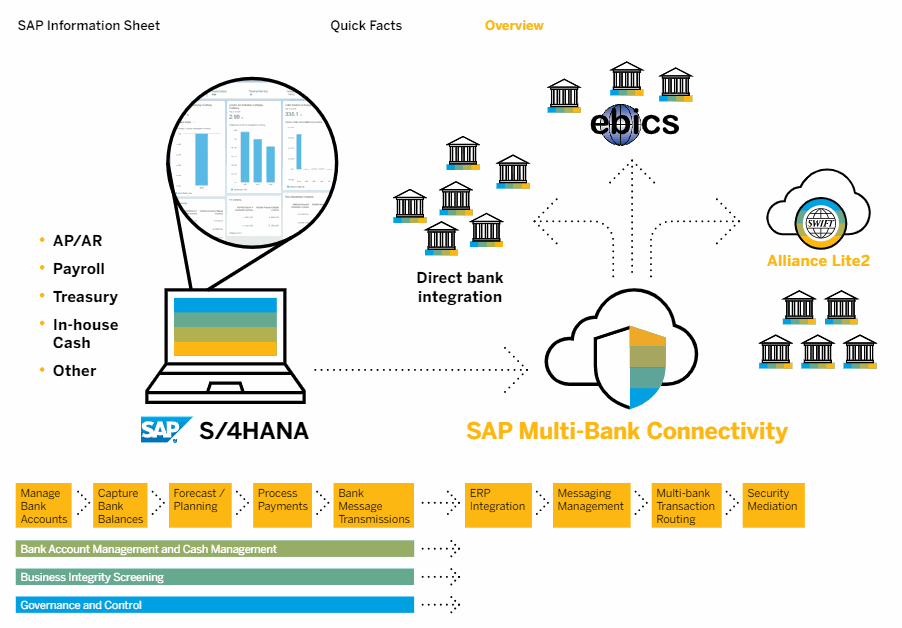

𝖳𝗁𝖾 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗂𝗌 𝖼𝗈𝗆𝗉𝗋𝗂𝗌𝖾𝖽 𝗈𝖿 𝗍𝗐𝗈 𝖾𝗅𝖾𝗆𝖾𝗇𝗍𝗌. 𝖳𝗁𝖾 𝖿𝗂𝗋𝗌𝗍 𝗂𝗌 𝗒𝗈𝗎𝗋 𝖽𝗂𝗀𝗂𝗍𝖺𝗅 𝖼𝗈𝗋𝖾, 𝖲𝖠𝖯 𝖲/𝟦𝖧𝖠𝖭𝖠 𝗈𝗋 𝖲𝖠𝖯 𝖤𝖱𝖯, 𝗐𝗁𝖾𝗋𝖾 𝖺 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗂𝗌 𝗍𝗋𝗂𝗀𝗀𝖾𝗋𝖾𝖽. 𝖳𝗁𝗂𝗌 𝗂𝗌 𝗐𝗁𝖾𝗋𝖾 𝗒𝗈𝗎 𝗆𝖺𝗇𝖺𝗀𝖾 𝗒𝗈𝗎𝗋 𝖻𝖺𝗇𝗄 𝖺𝖼𝖼𝗈𝗎𝗇𝗍, 𝗆𝖺𝗇𝖺𝗀𝖾 𝗒𝗈𝗎𝗋 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗐𝗂𝗍𝗁 𝖺𝗉𝗉𝗋𝗈𝗏𝖺𝗅 𝗐𝗈𝗋𝗄𝖿𝗅𝗈𝗐𝗌, 𝗆𝗈𝗇𝗂𝗍𝗈𝗋 𝗍𝗁𝖾 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝖾𝗇𝖽-𝗍𝗈-𝖾𝗇𝖽, 𝖺𝗇𝖽 𝖼𝖺𝗇 𝖽𝖾𝗍𝖾𝖼𝗍 𝖿𝗋𝖺𝗎𝖽. 𝖥𝗎𝗅𝗅𝗒 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝖾𝖽 𝗍𝗈 𝗂𝗍, 𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼-𝗍𝗂𝗏𝗂𝗍𝗒 𝗉𝗋𝗈𝗏𝗂𝖽𝖾𝗌 𝖺𝖽𝖽𝗂𝗍𝗂𝗈𝗇𝖺𝗅 𝗆𝖾𝗌𝗌𝖺𝗀𝗂𝗇𝗀 𝗆𝖺𝗇𝖺𝗀𝖾-𝗆𝖾𝗇𝗍 𝖺𝗇𝖽 𝗍𝗋𝖺𝗇𝗌𝖺𝖼𝗍𝗂𝗈𝗇 𝗋𝗈𝗎𝗍𝗂𝗇𝗀 𝖼𝖺𝗉𝖺𝖻𝗂𝗅𝗂𝗍𝗂𝖾𝗌 𝗎𝗌𝗂𝗇𝗀 𝗍𝗁𝖾 𝗁𝗂𝗀𝗁𝖾𝗌𝗍 𝗌𝖾𝖼𝗎𝗋𝗂𝗍𝗒 𝗌𝗍𝖺𝗇𝖽𝖺𝗋𝖽𝗌. 𝖳𝗁𝖾 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗈𝗇 𝖻𝖾𝗍𝗐𝖾𝖾𝗇 𝗍𝗁𝖾 𝗍𝗐𝗈 𝗂𝗌 𝖻𝖺𝗌𝖾𝖽 𝗈𝗇 𝗐𝖾𝖻 𝗌𝖾𝗋𝗏𝗂𝖼𝖾𝗌.

𝖳𝗁𝖺𝗇𝗄𝗌 𝗍𝗈 𝗍𝗁𝖾 𝗀𝗅𝗈𝖻𝖺𝗅 𝗋𝖾𝖺𝖼𝗁 𝗈𝖿 𝗍𝗁𝖾 𝖲𝖶𝖨𝖥𝖳 𝗇𝖾𝗍𝗐𝗈𝗋𝗄, 𝗏𝗂𝖺 𝖠𝗅𝗅𝗂𝖺𝗇𝖼𝖾 𝖫𝗂𝗍𝖾 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒, 𝗒𝗈𝗎 𝖼𝖺𝗇 𝖼𝗈𝗇𝗇𝖾𝖼𝗍 𝗐𝗂𝗍𝗁 𝗈𝗏𝖾𝗋 𝟣𝟣,𝟢𝟢𝟢 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌. 𝖠𝗇𝖽 𝖺𝗌 𝗈𝗇𝖻𝗈𝖺𝗋𝖽𝗂𝗇𝗀 𝗇𝖾𝗐 𝖻𝖺𝗇𝗄𝗌 𝗂𝗌 𝗌𝗂𝗆𝗉𝗅𝗂𝖿𝗂𝖾𝖽 𝖺𝗇𝖽 𝖺𝖼𝖼𝖾𝗅𝖾𝗋𝖺𝗍𝖾𝖽, 𝗒𝗈𝗎 𝖼𝖺𝗇 𝖼𝗁𝗈𝗈𝗌𝖾 𝗍𝗁𝖾 𝖻𝖺𝗇𝗄𝗌 𝗍𝗁𝖺𝗍 𝗆𝖾𝖾𝗍 𝗒𝗈𝗎𝗋 𝖼𝗁𝖺𝗇𝗀𝗂𝗇𝗀 𝗇𝖾𝖾𝖽𝗌, 𝗐𝗂𝗍𝗁𝗈𝗎𝗍 𝖻𝖾𝗂𝗇𝗀 𝗁𝖾𝗅𝖽 𝖻𝖺𝖼𝗄 𝖻𝗒 𝗅𝖾𝗇𝗀𝗍𝗁𝗒 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗉𝗋𝗈𝖼𝖾𝗌𝗌𝖾𝗌. 𝖸𝗈𝗎 𝖺𝗅𝗌𝗈 𝗁𝖺𝗏𝖾 𝗌𝗂𝗀𝗇𝗂𝖿𝗂𝖼𝖺𝗇𝗍𝗅𝗒 𝗂𝗆𝗉𝗋𝗈𝗏𝖾𝖽 𝗏𝗂𝗌𝗂𝖻𝗂𝗅𝗂𝗍𝗒 𝖺𝗇𝖽 𝖼𝗈𝗇𝗍𝗋𝗈𝗅 𝗈𝗏𝖾𝗋 𝗒𝗈𝗎𝗋 𝖾𝗑𝗂𝗌𝗍𝗂𝗇𝗀 𝖻𝖺𝗇𝗄𝗂𝗇𝗀 𝗋𝖾𝗅𝖺𝗍𝗂𝗈𝗇𝗌𝗁𝗂𝗉𝗌 𝗐𝗂𝗍𝗁 𝖺 𝗌𝗂𝗇𝗀𝗅𝖾, 𝖻𝖺𝗇𝗄-𝖺𝗀𝗇𝗈𝗌𝗍𝗂𝖼 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇.

𝖲𝖠𝖯 𝖬𝖡𝖢 𝗂𝗌 𝖺 𝗅𝗈𝗐-𝖿𝗈𝗈𝗍𝗉𝗋𝗂𝗇𝗍 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝖻𝖺𝗌𝖾𝖽 𝗈𝗇 𝖲𝖠𝖯 𝖢𝗅𝗈𝗎𝖽 𝖯𝗅𝖺𝗍𝖿𝗈𝗋𝗆. 𝖨𝗇𝗌𝗍𝖺𝗅-𝗅𝖺𝗍𝗂𝗈𝗇 𝗂𝗌 𝗊𝗎𝗂𝖼𝗄 𝖺𝗇𝖽 𝗌𝗂𝗆𝗉𝗅𝖾, 𝖺𝗇𝖽 𝗆𝖺𝗂𝗇𝗍𝖾𝗇𝖺𝗇𝖼𝖾 𝖺𝗇𝖽 𝗎𝗉𝗀𝗋𝖺𝖽𝖾𝗌 𝖺𝗋𝖾 𝖼𝖺𝗋𝗋𝗂𝖾𝖽 𝗈𝗎𝗍 𝖻𝗒 𝖲𝖠𝖯. 𝖳𝗁𝗂𝗌 𝗆𝖾𝖺𝗇𝗌 𝗒𝗈𝗎𝗋 𝗍𝗋𝖾𝖺𝗌𝗎𝗋𝗒 𝗁𝖺𝗌 𝗆𝗈𝗋𝖾 𝗍𝗂𝗆𝖾 𝗍𝗈 𝖿𝗈𝖼𝗎𝗌 𝗈𝗇 𝗌𝗍𝗋𝖺𝗍𝖾𝗀𝗒 𝖺𝗇𝖽 𝖽𝖾𝗅𝗂𝗏𝖾𝗋𝗂𝗇𝗀 𝗋𝖾𝖺𝗅 𝗏𝖺𝗅𝗎𝖾 𝗍𝗈 𝗒𝗈𝗎𝗋 𝗈𝗋𝗀𝖺𝗇𝗂𝗓𝖺𝗍𝗂𝗈𝗇. 𝖶𝗁𝖺𝗍’𝗌 𝗆𝗈𝗋𝖾, 𝗍𝗁𝖾 𝗌𝗈𝗅𝗎𝗍𝗂𝗈𝗇 𝗂𝗌 𝗇𝖺𝗍𝗂𝗏𝖾𝗅𝗒 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝖾𝖽 𝗐𝗂𝗍𝗁 𝗒𝗈𝗎𝗋 𝖽𝗂𝗀𝗂𝗍𝖺𝗅 𝖼𝗈𝗋𝖾, 𝖻𝖾 𝗂𝗍 𝖲𝖠𝖯 𝖲/𝟦𝖧𝖠𝖭𝖠 𝗈𝗋 𝖲𝖠𝖯 𝖤𝖱𝖯, 𝖾𝗑𝗍𝖾𝗇𝖽𝗂𝗇𝗀 𝗒𝗈𝗎𝗋 𝖾𝗑𝗂𝗌𝗍𝗂𝗇𝗀 𝗍𝗋𝖾𝖺𝗌𝗎𝗋𝗒 𝖼𝖺𝗉𝖺𝖻𝗂𝗅𝗂𝗍𝗂𝖾𝗌 𝖺𝗇𝖽 𝗁𝖾𝗅𝗉𝗂𝗇𝗀 𝗒𝗈𝗎 𝖾𝗌𝗍𝖺𝖻𝗅𝗂𝗌𝗁 𝖺𝗇 𝖾𝖿𝖿𝗂𝖼𝗂𝖾𝗇𝗍 𝖾𝗇𝖽-𝗍𝗈-𝖾𝗇𝖽 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗉𝗋𝗈𝖼𝖾𝗌𝗌.

𝖪𝖾𝗒 𝖡𝖾𝗇𝖾𝖿𝗂𝗍𝗌

𝖢𝗈𝗇𝗇𝖾𝖼𝗍 𝖻𝗎𝗌𝗂𝗇𝖾𝗌𝗌𝖾𝗌 𝗐𝗂𝗍𝗁 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌

𝖢𝗋𝖾𝖺𝗍𝖾 𝖺 𝗆𝗎𝗅𝗍𝗂-𝖻𝖺𝗇𝗄, 𝖽𝗂𝗀𝗂𝗍𝖺𝗅 𝖼𝗁𝖺𝗇𝗇𝖾𝗅 𝖻𝖾𝗍𝗐𝖾𝖾𝗇 𝗒𝗈𝗎𝗋 𝖤𝖱𝖯 𝗌𝗒𝗌𝗍𝖾𝗆 𝖺𝗇𝖽 𝗒𝗈𝗎𝗋 𝖻𝖺𝗇𝗄𝗌 𝗍𝗁𝖺𝗍 𝗈𝖿𝖿𝖾𝗋𝗌 𝖾𝗆𝖻𝖾𝖽𝖽𝖾𝖽 𝖤𝖡𝖨𝖢𝖲 𝖺𝗇𝖽 𝖲𝖶𝖨𝖥𝖳 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒.

𝖨𝗇𝖼𝗋𝖾𝖺𝗌𝖾 𝖼𝗈𝗇𝗍𝗋𝗈𝗅, 𝖾𝖿𝖿𝗂𝖼𝗂𝖾𝗇𝖼𝗒, 𝖺𝗇𝖽 𝗍𝗋𝖺𝗇𝗌𝗉𝖺𝗋𝖾𝗇𝖼𝗒

𝖱𝖾𝖿𝗂𝗇𝖾 𝖺𝗇𝖽 𝗌𝗂𝗆𝗉𝗅𝗂𝖿𝗒 𝗍𝗋𝖾𝖺𝗌𝗎𝗋𝗒 𝗈𝗉𝖾𝗋𝖺𝗍𝗂𝗈𝗇𝗌 𝖻𝗒 𝗎𝗉𝖽𝖺𝗍𝗂𝗇𝗀 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝗌𝗍𝖺𝗍𝗎𝗌 𝖺𝗇𝖽 𝖼𝖺𝗌𝗁 𝗉𝗈𝗌𝗂𝗍𝗂𝗈𝗇𝗌 𝖺𝗎𝗍𝗈𝗆𝖺𝗍𝗂𝖼𝖺𝗅𝗅𝗒 𝗂𝗇 𝗒𝗈𝗎𝗋 𝖤𝖱𝖯 𝗌𝗒𝗌𝗍𝖾𝗆.

𝖡𝗈𝗈𝗌𝗍 𝗍𝗁𝖾 𝗋𝖾𝗅𝗂𝖺𝖻𝗂𝗅𝗂𝗍𝗒 𝗈𝖿 𝗒𝗈𝗎𝗋 𝖻𝖺𝗇𝗄𝗂𝗇𝗀 𝗇𝖾𝗍𝗐𝗈𝗋𝗄

𝖠𝗎𝗍𝗈𝗆𝖺𝗍𝖾 𝗆𝖺𝗇𝗎𝖺𝗅, 𝖾𝗋𝗋𝗈𝗋-𝗉𝗋𝗈𝗇𝖾 𝗌𝗍𝖾𝗉𝗌 𝖺𝗌𝗌𝗈𝖼𝗂𝖺𝗍𝖾𝖽 𝗐𝗂𝗍𝗁 𝗍𝗁𝖾 𝖾𝗑𝖾𝖼𝗎𝗍𝗂𝗈𝗇 𝖺𝗇𝖽 𝗋𝖾𝖼𝗈𝗇𝖼𝗂𝗅𝗂𝖺𝗍𝗂𝗈𝗇 𝗈𝖿 𝗉𝖺𝗒𝗆𝖾𝗇𝗍𝗌, 𝗈𝗋𝖽𝖾𝗋-𝗍𝗈-𝖼𝖺𝗌𝗁 𝖺𝗉𝗉𝗅𝗂𝖼𝖺𝗍𝗂𝗈𝗇𝗌, 𝖺𝗇𝖽 𝗈𝗋𝖽𝖾𝗋 𝖾𝗇𝗍𝗋𝗒 𝖽𝗈𝖼𝗎𝗆𝖾𝗇𝗍𝗌.

𝖪𝖾𝗒 𝖢𝖺𝗉𝖺𝖻𝗂𝗅𝗂𝗍𝗂𝖾𝗌

𝖲𝖾𝖼𝗎𝗋𝖾 𝗆𝗎𝗅𝗍𝗂-𝖻𝖺𝗇𝗄 𝖺𝗇𝖽 𝗆𝗎𝗅𝗍𝗂-𝖼𝗈𝗋𝗉𝗈𝗋𝖺𝗍𝖾 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒

𝖤𝗇𝖺𝖻𝗅𝖾 𝖽𝗂𝗋𝖾𝖼𝗍 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗐𝗂𝗍𝗁 𝗉𝖺𝗒𝗆𝖾𝗇𝗍 𝖺𝗉𝗉𝗋𝗈𝗏𝖺𝗅 𝗉𝗋𝗈𝖼𝖾𝗌𝗌𝖾𝗌

𝖱𝖾𝗆𝗈𝗏𝖾 𝖿𝗂𝗅𝖾- 𝖺𝗇𝖽 𝗆𝗂𝖽𝖽𝗅𝖾𝗐𝖺𝗋𝖾-𝖻𝖺𝗌𝖾𝖽 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗐𝗂𝗍𝗁 𝖺 𝗌𝖾𝗋𝗏𝗂𝖼𝖾-𝖻𝖺𝗌𝖾𝖽 𝗈𝖿𝖿𝖾𝗋𝗂𝗇𝗀 𝗎𝗇𝗂𝖿𝗂𝖾𝖽 𝗐𝗂𝗍𝗁 𝖤𝖱𝖯

𝖠𝖽𝖽 𝖾𝗇𝖼𝗋𝗒𝗉𝗍𝗂𝗈𝗇 𝖺𝗇𝖽 𝖽𝗂𝗀𝗂𝗍𝖺𝗅 𝗌𝗂𝗀𝗇𝖺𝗍𝗎𝗋𝖾𝗌 𝗍𝗈 𝗆𝖾𝗌𝗌𝖺𝗀𝖾𝗌 𝖾𝗑𝖼𝗁𝖺𝗇𝗀𝖾𝖽 𝗐𝗂𝗍𝗁 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌

𝖨𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝗐𝗂𝗍𝗁 𝖺𝗅𝗅 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗌𝖾𝗋𝗏𝗂𝖼𝖾𝗌 𝗉𝗋𝗈𝗏𝗂𝖽𝖾𝗋𝗌

𝖤𝗆𝖻𝖾𝖽 𝖲𝖶𝖨𝖥𝖳 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇 𝖻𝖺𝗌𝖾𝖽 𝗈𝗇 𝖺 𝗉𝖺𝗋𝗍𝗇𝖾𝗋𝗌𝗁𝗂𝗉 𝖻𝖾𝗍𝗐𝖾𝖾𝗇 𝖲𝖠𝖯 𝖺𝗇𝖽 𝖲𝖶𝖨𝖥𝖳

𝖱𝖾𝖺𝖼𝗁 𝖺 𝗅𝖺𝗋𝗀𝖾 𝗇𝗎𝗆𝖻𝖾𝗋 𝗈𝖿 𝖻𝖺𝗇𝗄𝗌 𝖻𝗒 𝗎𝗌𝗂𝗇𝗀 𝖺 𝗌𝗍𝖺𝗇𝖽𝖺𝗋𝖽 𝖾𝗑𝖼𝗁𝖺𝗇𝗀𝖾 𝗉𝗋𝗈𝗍𝗈𝖼𝗈𝗅 𝖻𝖺𝗌𝖾𝖽 𝗈𝗇 𝖤𝖡𝖨𝖢𝖲

𝖥𝖺𝖼𝗂𝗅𝗂𝗍𝖺𝗍𝖾 𝗁𝗈𝗌𝗍-𝟤-𝗁𝗈𝗌𝗍 𝖼𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗍𝗈 𝖿𝗂𝗇𝖺𝗇𝖼𝗂𝖺𝗅 𝗂𝗇𝗌𝗍𝗂𝗍𝗎𝗍𝗂𝗈𝗇𝗌

𝖳𝖾𝖼𝗁𝗇𝗂𝖼𝖺𝗅 𝖨𝗇𝖿𝗈𝗋𝗆𝖺𝗍𝗂𝗈𝗇

𝖳𝗁𝗂𝗌 𝗉𝗋𝗈𝖽𝗎𝖼𝗍 𝗂𝗌 𝖽𝖾𝗉𝗅𝗈𝗒𝖾𝖽 𝗂𝗇 𝗍𝗁𝖾 𝖼𝗅𝗈𝗎𝖽 𝖺𝗇𝖽 𝗂𝗌 𝖺𝗏𝖺𝗂𝗅𝖺𝖻𝗅𝖾 𝖺𝗌 𝗌𝗈𝖿𝗍𝗐𝖺𝗋𝖾 𝖺𝗌 𝖺 𝗌𝖾𝗋𝗏𝗂𝖼𝖾 (𝖲𝖺𝖺𝖲), 𝗌𝗈 𝗒𝗈𝗎 𝖼𝖺𝗇 𝖺𝖼𝖼𝖾𝗌𝗌 𝗒𝗈𝗎𝗋 𝗌𝗈𝖿𝗍𝗐𝖺𝗋𝖾 𝖿𝗋𝗈𝗆 𝖺𝗇𝗒 𝖶𝖾𝖻 𝖻𝗋𝗈𝗐𝗌𝖾𝗋.

𝖨𝗇𝗌𝗍𝖺𝗅𝗅𝖺𝗍𝗂𝗈𝗇 𝖺𝗇𝖽 𝗌𝖾𝗍𝗎𝗉

𝖥𝗂𝗇𝖽 𝗈𝗎𝗍 𝗁𝗈𝗐 𝗒𝗈𝗎 𝖼𝖺𝗇 𝗌𝖾𝖺𝗆𝗅𝖾𝗌𝗌𝗅𝗒 𝗂𝗇𝗌𝗍𝖺𝗅𝗅 𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗐𝗂𝗍𝗁 𝗒𝗈𝗎𝗋 𝖾𝗑𝗂𝗌𝗍𝗂𝗇𝗀 𝖨𝖳 𝗅𝖺𝗇𝖽𝗌𝖼𝖺𝗉𝖾.

𝖢𝗈𝗇𝖿𝗂𝗀𝗎𝗋𝖺𝗍𝗂𝗈𝗇

𝖮𝗉𝗍𝗂𝗆𝗂𝗓𝖾 𝖼𝗈𝗇𝖿𝗂𝗀𝗎𝗋𝖺𝗍𝗂𝗈𝗇 𝗈𝖿 𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗐𝗂𝗍𝗁 𝗈𝗎𝗋 𝖼𝗈𝗆𝗉𝗋𝖾𝗁𝖾𝗇𝗌𝗂𝗏𝖾 𝖼𝗈𝗇𝖿𝗂𝗀𝗎𝗋𝖺𝗍𝗂𝗈𝗇 𝗀𝗎𝗂𝖽𝖾.

𝖨𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝗂𝗈𝗇

𝖥𝗂𝗇𝖽 𝗈𝗎𝗍 𝗁𝗈𝗐 𝗒𝗈𝗎 𝖼𝖺𝗇 𝗌𝖾𝖺𝗆𝗅𝖾𝗌𝗌𝗅𝗒 𝗂𝗇𝗍𝖾𝗀𝗋𝖺𝗍𝖾 𝖲𝖠𝖯 𝖬𝗎𝗅𝗍𝗂-𝖡𝖺𝗇𝗄 𝖢𝗈𝗇𝗇𝖾𝖼𝗍𝗂𝗏𝗂𝗍𝗒 𝗐𝗂𝗍𝗁 𝗒𝗈𝗎𝗋 𝖾𝗑𝗂𝗌𝗍𝗂𝗇𝗀 𝖨𝖳 𝗅𝖺𝗇𝖽𝗌𝖼𝖺𝗉𝖾.

About the Author

Joe Torres is the Founder and CEO of DYCSI Inc. He has over two decades of senior management experience in the IT and financial services industry with institutions such as Nacional Monte de Piedad and Banco Actinver.

Joe has seen success with roles in Technology Evolution, Bank Operations, Treasury and Risk Management, Contract and Lease Management and Money Laundry Prevention Systems, Banking Tellers and Emerging Technologies to Deliver Business Value.